What Is Trade Credit Insurance for Beginners

Rumored Buzz on What Is Trade Credit Insurance

Table of ContentsWhat Does What Is Trade Credit Insurance Do?What Does What Is Trade Credit Insurance Mean?The Basic Principles Of What Is Trade Credit Insurance The Greatest Guide To What Is Trade Credit InsuranceGet This Report on What Is Trade Credit Insurance

ECI, the cost of which is frequently incorporated right into the marketing cost by exporters, need to be a proactive acquisition, because exporters should get insurance coverage before a customer becomes a trouble. ECI policies are offered by several personal industrial danger insurer in addition to the Export-Import Bank of the USA (EXIM), the government firm that helps in financing the export of united state

For much more on credit report insurance coverage, visit the EXIM web site.

The Definitive Guide to What Is Trade Credit Insurance

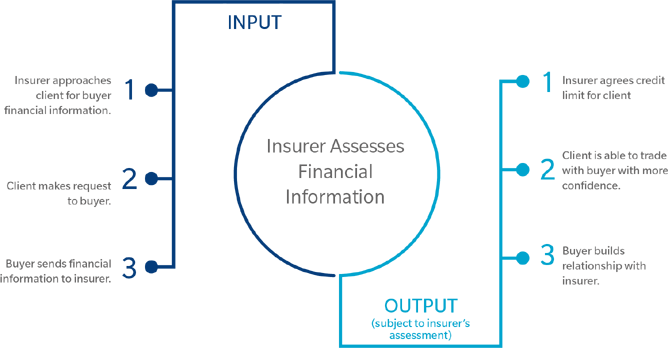

Trade Credit scores Insurance supplies access to info held by insurance providers concerning the financial wellness of companies you are intending to do business with. Insurance companies can share this information with their insurance holders. Your customers have a beneficial interest in ensuring their vendors can get trade debt insurance coverage and also offer information of their approximately date trading activity to the insurance firms.

If you are considering utilizing billing finance, trade credit rating insurance coverage can give your finance business with the protection they need to offer added financing. Using Trade Credit score Insurance policy to offer clients as well as leads extra favourable credit history settlement terms and also restrictions. This could have a tangible impact on your sales performance.

While we have no known connection to Julie Andrews, right here at The Channel Partnership our company believe in being familiar with our client. Above all, please don't believe we just 'provide' trade credit report insurance policy. Our solution goes past that even if you select not to collaborate with us at the end of the day.

The Ultimate Guide To What Is Trade Credit Insurance

Or, if we believe that debt insurance isn't ideal for your company, then we'll be honest and also make the effort to discuss why we think this is and also information alternate choices we think it's the appropriate point to do. We value our people that are the backbone to what we do, as well as this is reflected in the solution that we provide to our consumers.

For many businesses, the value of the borrower's ledger, the cash you are owed, is one of the biggest assets as well as yet it is typically not guaranteed. Many organizations make sure various other essential properties readily, yet the threat to a service of consumer insolvency can be among one of the most unpredictable direct exposures.

Unless you require payment ahead of time or are covered by credit history insurance, this makes you susceptible to uncollectable loan (What is trade credit insurance). Ask yourself, what would certainly be the influence of among your biggest customers stopping working to pay you? Any type of organization selling products as well as solutions on credit scores terms with direct exposures to negative debts ought to strongly think about profession credit rating insurance as part of their service threat approach.

Profession Credit rating Insurance coverage is greatly utilized in the Structure and also Building and construction field and also used by businesses of all sizes with minimum annual turnover usually beginning around $750,000 upwards. There is no 'one dimension fits all' strategy when it comes to Profession Credit rating Insurance and the degree and cost of your policy will be dictated by your needs.

The What Is Trade Credit Insurance Ideas

For 2 years business has actually been damaged. We have a broad option of products like it ensured to insure your company versus the unexpected; locate out which one works for you.

Our primary emphasis is to be the leading Trade Credit website link scores, Insurance in addition to Guaranty & Bonds solutions carrier, by supporting our clients' expanding demand throughout, Africa. Get an insightful, inside view profession credit rating insurance coverage with our most current news as well as updates.

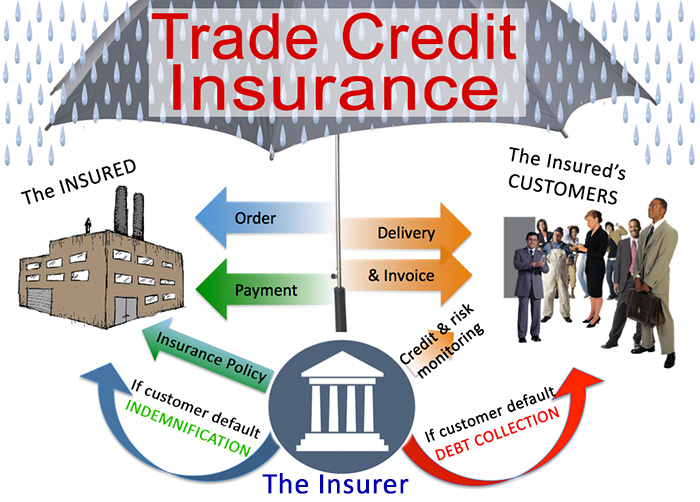

Profession credit rating insurance policy is a method of safeguarding your balance dues (invoices) from non repayment. It is a progressively prominent type of defense versus consumers which either reject to, or can not, pay their financial debts. What is trade credit insurance. Allow's discover just how it functions Material Profession credit insurance, sometimes called 'bad financial debt defense', is an insurance policy cover for organizations versus clients who don't pay their financial debts.

It can be made use of as a standalone item covering the entire company receivable; as a screw on for invoice finance; or to cover a particular section of a business's invoices, as an example those from exports just. Trade credit score insurance is currently a prominent field with various options tailored to various sections of the market.

Everything about What Is Trade Credit Insurance

Experts use what are called actuarial methods (analytical evaluation of threat in insurance) to look at the market of profession, the credit rating of the business entailed, previous uncollectable bill experience and a number of various other factors. Based on this evaluation, the expert will establish a credit line for each business to which the credit rating insurance coverage will use.

In some circumstances Recommended Reading this may not cover the total amount of the profession yet a percent only. In addition to its fundamental security, credit insurance coverage has the included worth of providing understanding right into the credit-worthiness of your consumers (What is trade credit insurance). This might permit you to make smarter strategic decisions as you grow the company.